Understanding GSTR-1, GSTR-2, and GSTR-3B: A Complete Guide, Get Practical GST Course in Delhi, 110071, by SLA Consultants India, New Delhi,

Jun 6th, 2025 at 10:47 Learning Delhi 6 views Reference: 291Location: Delhi

Price: Contact us Negotiable

Understanding GSTR-1, GSTR-2, and GSTR-3B: A Complete Guide

For GST-registered businesses in India, GSTR-1, GSTR-2, and GSTR-3B are foundational returns that ensure proper tax compliance and smooth Input Tax Credit (ITC) flow. Here’s a detailed guide to these returns, their differences, and their significance.

GSTR-1: Outward Supplies Return

-

Purpose: GSTR-1 captures detailed information about all outward supplies (sales) made by a business in a given tax period. It includes invoice-wise details for B2B and B2C transactions, debit/credit notes, and any amendments to previous supplies.

-

Filing Frequency: Monthly for businesses with turnover above ₹1.5 crore; quarterly for those below this threshold.

-

Key Points:

-

Focuses solely on outward supplies and revenue generation.

-

Forms the basis for the recipient's ITC claim, as details auto-populate into their GSTR-2A/2B.

-

Accurate and timely filing is critical to avoid ITC disputes and penalties.

-

GSTR-2: Inward Supplies Return (Currently Suspended)

-

Purpose: GSTR-2 was designed to report all inward supplies (purchases) received by a business, including details of ITC available.

-

Status: The filing of GSTR-2 has been suspended since 2017 due to technical and practical challenges. Instead, businesses now rely on auto-drafted statements like GSTR-2A and GSTR-2B for ITC reconciliation.

-

Key Points:

-

GSTR-2A is a dynamic, auto-populated statement reflecting suppliers’ GSTR-1 filings.

-

GSTR-2B is a static monthly statement, generated on the 14th of each month, showing eligible and ineligible ITC for that period.

-

GSTR-3B: Summary Return

-

Purpose: GSTR-3B is a monthly (or quarterly under QRMP) self-declaration summary return. It reports total outward supplies, inward supplies, ITC claimed, and tax liability for the period.

-

Filing Frequency: Mandatory for all regular taxpayers, regardless of turnover, on a monthly or quarterly basis.

-

Key Points:

-

Provides a consolidated summary of sales, purchases, ITC claims, and tax payments.

-

Tax payment is mandatory before filing GSTR-3B.GST Institute in Delhi

-

No invoice-level detail is required—only summary figures.

-

Key Differences: GSTR-1 vs. GSTR-3B

| Aspect | GSTR-1 | GSTR-3B |

|---|---|---|

| Content | Detailed invoice-wise outward supply data | Summary of sales, purchases, ITC, and tax payment |

| Purpose | Reporting sales for ITC flow | Tax liability declaration and payment |

| Filing Frequency | Monthly/Quarterly | Monthly/Quarterly |

| Tax Payment | Not required at filing | Mandatory before filing |

| Penalties | ₹200/day (₹100 CGST + ₹100 SGST) | ₹50/day (₹25 CGST + ₹25 SGST), ₹20/day for nil |

Recent Updates (April 2025 Onwards)

-

Table-12 of GSTR-1: Restructured for better HSN-wise reporting, reducing errors and improving compliance.

-

Table 3.2 of GSTR-3B: Revised for more accurate inter-state supply reporting, with auto-populated values to minimize mistakes.

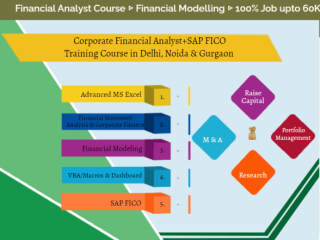

Get Practical GST Course in Delhi, 110071, by SLA Consultants India

SLA Consultants India offers a leading GST practical training program in Delhi, including the 110071 area, tailored for professionals and graduates aiming for expertise in GST compliance and return filing9.

Course Highlights:

-

Comprehensive coverage of GSTR-1, GSTR-3B, GSTR-2A/2B, ITC reconciliation, and the latest GST updates.

-

Real-time assignments, GST software training, and live case studies.

-

Expert faculty with years of industry experience.

-

Flexible classroom and online batches.

-

100% job placement support for career advancement.

Summary:

GSTR-1, GSTR-2 (via 2A/2B), and GSTR-3B are central to GST compliance. GSTR-1 details sales, GSTR-3B summarizes liabilities and ITC, and GSTR-2A/2B help reconcile ITC. SLA Consultants India’s GST course in Delhi provides practical mastery of these returns, ensuring robust compliance and career growth9.

SLA Consultants Understanding GSTR-1, GSTR-2, and GSTR-3B: A Complete Guide, Get Practical GST Course in Delhi, 110071, by SLA Consultants India, New Delhi, details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar, New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/